Redefining Credit Decisions in AfricaWith AI & Alternative Data

Empowering lenders and other institutions across Africa with cutting-edge credit intelligence and digital verification solutions.

.

Empowering Africa's LeadingFinancial Institutions

Join 230+ banks, microfinance institutions, microfinance banks, and fintech companies transforming credit decisions and identity/business verification across the continent

Why Spinmobile

Comprehensive credit intelligence solutions designed to transform your lending decisions with cutting-edge technology and unmatched reliability.

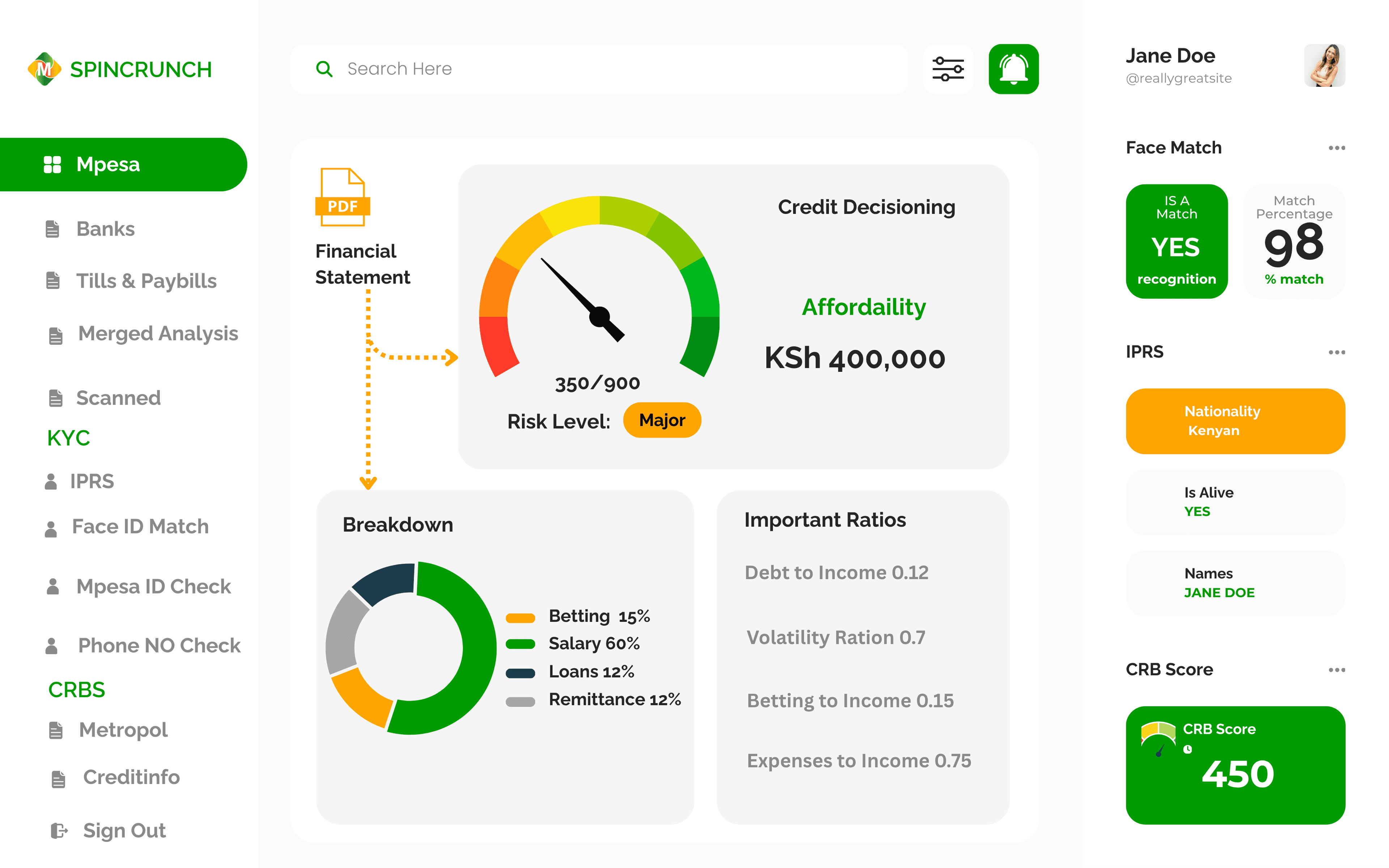

Credit Decisioning

Understand the borrowing behavior as well as the affordability capacity of your borrower.

Credit Risk Analysis

Get the risk profile of your borrower, from insignificant risk to catastrophic risk.

Fraud Detection

Do not be a victim of financial fraud. Let us help you weed out the fraudsters.

Seamless Integration

Our clearly documented APIs ensure smooth and hassle-free integration.

Behaviour Analysis

Get a deep understanding of how your customer spends their money.

KYC Verification

Be 100% sure that people are who they say they are.

CRB Checks

Access to clients credit history, and CRB score.

Data Privacy

Compliant with the Data Protection Act and best security practices.

Skip Tracing

Get a picture of where to easily find your customer.

Build with Powerful APIs

Integrate credit intelligence into your applications with our developer-friendly API and comprehensive tooling.

// Assess credit from bank statement

POST /api/v1/assess

Headers: Authorization: Bearer YOUR_TOKEN

Body: statement: client_statement.pdf

Response:

{

"score": 750,

"affordability": "KES 45,000",

"classification": "Low Risk",

"key_ratios": {

"debt_to_income": "28%",

"savings_rate": "15%"

}

}Real-Time Processing

Get credit decisions in milliseconds with our high-performance infrastructure built for scale.

Rich Documentation

Interactive API references, tutorials, and guides to get you up and running quickly.

AI-Powered Models

Access cutting-edge machine learning models trained on credit data.

Transforming Financial ServicesAcross Every Sector

From traditional banks to innovative microfinance institutions, we provide tailored solutions for every type of financial institution

Scroll to explore more sectors

What Our Customers Say

Hear directly from our customers about how our credit intelligence platform has transformed their lending operations and customer experience.